Monday, September 6, 2010

ONE STORY

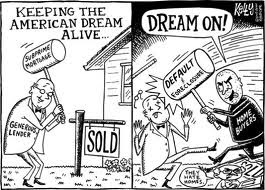

We have all read and heard the recent news stories of families that are in difficult mortgage related positions, some of which immediately entered into a negative equity position. Dispatches recently reported thousands of people were accepted for 125% interest only mortgages by the five leading banks and some bank clients that were allowed to obtain a mortgage of 10 times their earnings. How could this ever be described as responsible lending?

The credit crunch has brought many negative aspects to the economy including to the current housing market. However, the fact that mortgage lenders have been forced to re-evaluate their lending policies and procedures can only be welcomed. Unfortunately, it may of come too late for those in the difficult positions described above.

Current lending has returned to more ’sensible’ levels with very high multiple earnings and greater than 95% mortgages resigned to the past for the time being. Risk to the client and the banks is now a serious consideration where it was to an extent disregarded as the housing market boomed and the banks felt that they could not lose.

The calculations that are used by mortgage lenders are quite complex though general levels can be calculated using the following formula:

•Three times the greater income

•Two and a half times both annual incomes

[Image]It is now likely that the loan to value (LTV) will be at the greatest 95% though levels of 75% are more commonly found, therefore requiring a substantial deposit. A ‘good’ deposit has always been beneficial to securing preferential rates though now it is undoubtedly seen as essential.Income multiples are becoming a less accurate method of calculating potential lending levels and most banks consider an affordablity criteria based upon income and expenditure. This is a more accurate calculation for sustainable mortgage repayments. Some of the expenditure that is widely taken into account are:

•travel and transport costs

•food budgets

•council tax

•insurance premiums

•monthly credit card bills

•whether you have children and related costs

•household bills

By using this information the mortgage lender can evaluate a better picture of what is achievable to be consistently repaid. This has to be welcomed as a much more responsible way of calculating potential borrowing.

As the the pool of money available to be utilised for mortgages is reduced, banks ultimately look at further criteria on whether to accept an applicant. Credit scoring and history is considered and areas that have an impact include:

•Have you been more than 30 days late on your rent or mortgage?

•Have you been more than 30 days late on your car payment?

•Have you been more than 30 days late on your credit cards?

•Do you have any bankruptcies, defaults or repossessions?

•Do you have student loans?

•Do you have any debts from a previous marriage?

•Do you have four lines of credit that are at least 2 years old?

You’ve a statutory right under the Consumer Credit Act 1974, to write and get your files and costs £2 per agency. The big three credit agencies are Equifax Online, Experian Online, Callcredit Online.

View your Free Experian Credit Report Now.

Success of morgage applications is certainly reducing and whereas once the above points were considered they are now more strictly followed. This must feel harsh to those that are declined mortgages who do not meet the ‘new’ criteria and would of previously been accepted. However, with this comes the potential for increased successsful repayments of mortgages and a long term reduction in the number of repossessions that are currently occuring

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment